As the world looks forward to post-pandemic life, our team has been keeping a pulse on how the pandemic has shifted consumers’ shopping habits on Amazon. SupplyKick works with hundreds of partners across consumer categories, and to best meet their needs and the needs of their customers, we’re constantly tracking changes in Amazon consumer preferences and identifying opportunities for marketplace growth.

Because 60% of consumer interactions with companies take place online in 2021 (compared to 42% in 2019)—and 66% of every product search begins on Amazon—it’s essential for brands in the digital marketplace to understand what consumers are looking for and how to reach them on Amazon. Insights from Covid-era shopping trends suggest that ecommerce sales will maintain their momentum for the foreseeable future, and so will the Covid-era activities of consumers who now prioritize digital convenience, frugality, and self-care.

We’ve identified five successful and high-potential categories for sellers to keep an eye on, along with examples of brands who are excelling in them. Here’s what we know about these trending Amazon categories:

After spending more time at home, consumer desire to enhance outdoor living spaces led to a 40% increase in time spent gardening in 2020. 86% plan to garden the same amount of time throughout 2021. Along with the aspiration to build their own outdoor oasis, consumers are also motivated to grow their own fruits, vegetables, and herbs. We expect this to go hand in hand with increased demand for Patio, Lawn & Garden products, an Amazon category that has seen significant growth over the past year.

At SupplyKick, we’ve seen brands excel in the Patio, Lawn & Garden category firsthand. TDI has partnered with us since 2019 to capture marketplace control, enhance and optimize their product listings, and streamline the Amazon selling process. In 2020, restaurants used TDI Sunbubble Greenhouses to establish safe, outdoor dining experiences. TDI’s forward-thinking practices and product expansion on Amazon drove them to $2M in Amazon sales in 2020. Already in 2021, they’ve seen a 55% increase in traffic YoY and a 157% increase in shipments to Amazon between January-April.

In the Tools & Home Improvement category, ecommerce growth is outpacing brick and mortar growth 6:1—and Amazon holds 82% of online home improvement market sales. With relatively low barriers to entry, Amazon is welcoming more new-to-market brands than brick and mortar marketplaces. Moderate cost and minimal installation brands are finding success among Covid-era consumers looking to make big design impacts on smaller budgets—76% of homeowners in the US have carried out at least one home improvement project since the start of the pandemic. Lockdowns have inspired a collective passion for home improvement and remodeling projects that continue to thrive throughout 2021.

SupplyKick partners Madelyn Carter, Lucci Air, and Johnson Hardware have all seen the effects of this rising popularity over the past year and have capitalized on this growth with innovative marketplace strategies, increased attention to brand marketing, and product launch expansions. For example, Madelyn Carter first partnered with us in July of 2020. Their large and complex product assortment made them an excellent candidate for us to launch their Storefront, which is now driving nearly 14% of marketplace sales! Graphic photography, listing optimization, specs and tutorials, and more have helped to mitigate product returns and keep customers happy, and Madelyn Carter plans to launch 6-8 new vent cover designs on Amazon this fall.

The Sports & Outdoors category presents new opportunities for sellers on the marketplace—in 2020, Sports & Outdoors grew 80% YoY on Amazon. Covid-era consumers continue to embrace the outdoor lifestyle, seek new hobbies, and stay fit with at-home gyms and remote exercise classes. The growth of this category transcends seasons, too, as winter sports and indoor team activities are also experiencing increased participation.

Take a look at the growth of specific sports categories from June 2020:

High-performing Sports & Outdoors categories are expected to remain popular throughout 2021 and beyond. In the US market, Sports & Outdoor brand revenue is poised to climb 14% this year. Our partners at Paddletek have taken advantage of the rise in popularity among Amazon shoppers and continue to see tremendous growth in 2020 and 2021.

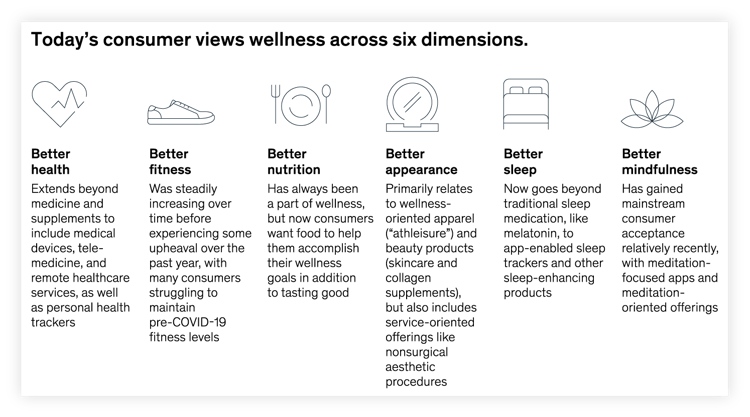

The pandemic shifted consumer priorities to actively pursue self-care, health, and fitness in a holistic sense. It looks like wellness is here to stay as consumers across the globe plan to increase spending related to physical and mental health. Beauty, health, and personal care on Amazon had a 45% increase YoY with $23 billion in sales.

|

| Source: McKinsey & Company |

In 2020, Google searches for self-care products went up 250%. One-third of consumers have increased self-care behavior during the past year, and at least 77% aspire to make more attempts to stay healthy in the future. Amazon is the perfect marketplace if you’re targeting consumers in self-improvement categories—one third of all beauty bought online happens on Amazon. The wellness market overall is in a stage of rapid growth, with a current estimated value of $1.5 trillion. Cue the opportunity!

We also need to pay close attention to the industry that supports our furry friends: Pet Supplies. The pandemic has driven consumers to spoil their pets more than ever before. 71% of pet owners now say they order and buy online more, and 30% spent more on their pet in the past year (at SupplyKick, we’re no strangers to being pet lovers and definitely did the same).

Pet Supplies on Amazon grew 30% YoY in 2020, and the category has expanded into a range of subcategories: food, toys, beds, leashes, hygiene, pet grooming, the list goes on. Amazon is the place to be for online Pet Supplies sales—it leads in growth over pet specialists like Chewy and PetSmart. The Pet Supplies industry reached $100 billion in sales last year, and it’s expected to make $109.6 billion in sales in 2021. And the online Pet Supplies boom isn’t going anywhere: by 2024, ecommerce will be the top retail sales channel for pet products.

Ready to grow your brand on Amazon in any of these trending categories? Frustrated with your current sales or growth in these categories? That’s what we’re here for. Discover whether you’d like to explore a Wholesale or Agency partnership with SupplyKick, or start a conversation with our team.

To stay updated on the latest Amazon trends, news, and insights, subscribe to our weekly newsletter, and don’t miss our take on the top Amazon seller and shopper trends of 2021.

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Sign up to receive our newsletter for growth strategies, important updates, inventory and policy changes, and best practices.

These Stories on SupplyKick

For press inquiries, please contact Molly Horstmann, mhorstmann@supplykick.com